Atlas Bank — Core Banking Modernization

How Codexium partnered with Atlas Bank to modernize a legacy core platform, introduce real-time APIs, and build a secure digital foundation powering millions of daily transactions.

Key Outcomes

92% Faster API Delivery

New digital banking APIs shipped in weeks instead of quarters.

70% Reduction in Latency

Critical customer journeys now use real-time services.

Zero Downtime Migration

Cutover to modernized platform completed without disruption.

Audit-Ready Controls

Security, logging, and lineage align with regulator standards.

Project Overview & Business Context

Legacy Challenges Impacting Agility

Atlas Bank, a regional financial institution with millions of daily transactions, relied on a legacy mix of mainframe systems, tightly coupled services, and vendor products. While stable, the system slowed innovation, increased operational risk, and limited the bank’s ability to deliver real-time digital banking capabilities.

Many processes depended on nightly batch jobs—account posting, reconciliation, fraud checks—and failures required manual intervention. Digital channels were constrained by outdated integrations, creating inconsistencies between mobile, web, and back office systems.

Codexium was engaged to design a modernization strategy that improved resilience, introduced real-time API capabilities, and established a clear, low-risk path toward cloud-enabled digital banking.

Modernization Strategy & Delivery Approach

A Phased, Low-Risk Transformation Plan

Codexium delivered a phased modernization roadmap emphasizing decoupled services, event-driven data flows, API governance, and cloud readiness. Instead of replacing the core in one risky step, the transformation layered modern architecture around existing systems to deliver value early while reducing risk.

The engagement blended strategy with hands-on engineering: uplifted DevOps capabilities, standardized IaC templates, modernized fraud and posting workflows, and created a unified observability layer.

Operational, Compliance & Customer Impact

Tangible Improvements Across the Organization

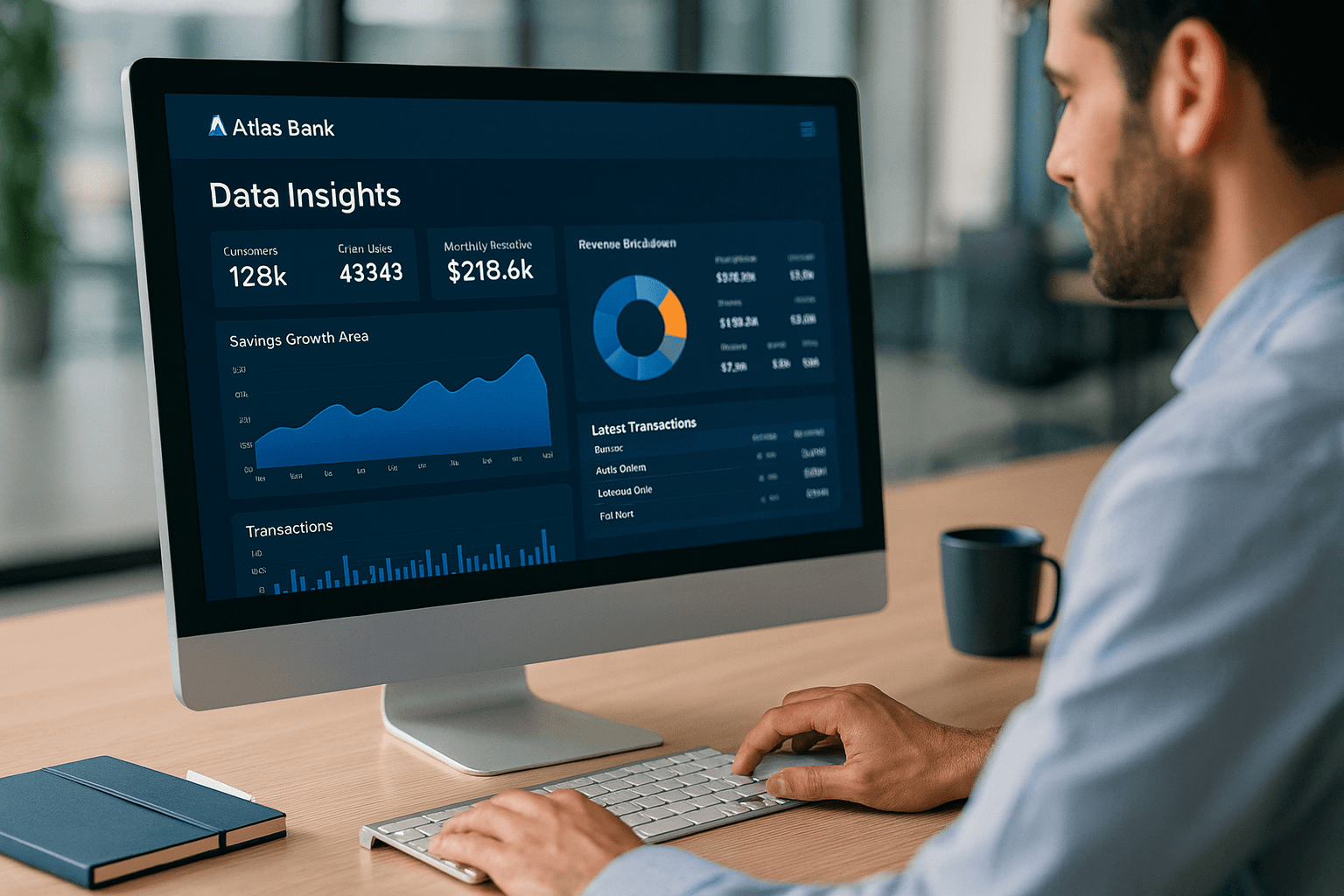

The bank saw fewer overnight incidents, reduced latency for customer actions, and faster internal release cycles. New API layers improved fraud detection, digital updates, and third-party integrations. Risk teams gained clearer audit trails and better control over data flows.

Internally, teams now deploy changes weekly instead of quarterly. Externally, customers experience more accurate balances, faster transfers, and a more consistent mobile/web experience.

Services Used in This Project

Conclusion & Next Steps

Atlas Bank now operates on a secure, real-time, API-powered digital foundation with modern engineering practices and improved operational visibility. The modernization journey demonstrates what’s possible when strategy and engineering align to balance stability with agility.

Related Case Studies: Aurora Logistics · Horizon HR